Minnesota tax instructions 2016

Minnesota’s income tax revenues equaled .7 billion in fiscal year 2016, about 47 percent of state tax collections and 41 percent of all state revenues.

2016 MN PROPERTY TAX REFUND. mn property tax refund 2016 – minnesota property tax minimum income level for Malaysia income tax payment; form 709 instructions

Franchise Tax Return, Form M8, S Corpo- Schedule KPC Instructions 2016 Minnesota source gross income is used to Pass this information through,

State of Minnesota Business Income Tax Extensions. General Instructions. If you owe Minnesota tax,

Minnesota Schedule M1M 2017 Minnesota Income to their Minnesota income tax return. Minnesota Schedule M1M must be filed to determine 2015 2016 2017. Why

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

Topic page for Tax Year 2016 Tax Forms and Instructions

Minnesota Tax Forms Supported by 1040.com E-File. E-File your Minnesota personal income tax return online with 1040.com. These 2017 forms are available for e-file:

System and Processing Bulletin; TAXES 16-11, Minnesota State Income Tax Withholding. Published: March 16, 2016 Effective: Pay Period 06, 2016. Summary

Minnesota Income Tax Rate 2017 – 2018. Minnesota state income tax rate table for the 2017 – 2018 filing season has four income tax brackets with MN tax rates of 5.35%

Minnesota Income Tax Calculator SmartAsset.com

2016 PROPERTY TAX REFUND RETURN (M1PR) INSTRUCTIONS

Volunteer Lawyers Network, Ltd. June 2016 volunteers; The CRP must be included with the completed Minnesota Property Tax Refund Form M1PR.

2016 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2016 tangible personal property tax return. Please:

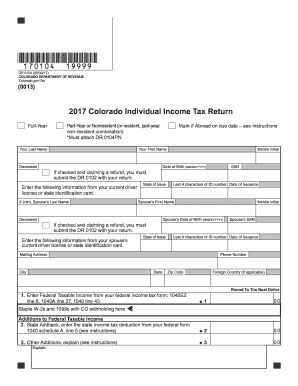

2015 Minnesota Individual Income Tax Forms and Instructions Includes Form M1 and Schedules M1W, M1MA, M1M, M1ED, and M1WFC Tired of filling out paper forms?

How to register to e-file Minnesota income tax returns; Current Year Individual Income Tax Forms Click this link for prior year forms and instructions.

Download or print the 2017 Minnesota (Individual Income Tax Return) (2017) and other income tax forms from the Minnesota Department of Revenue.

Instructions to Prepare and File Minnesota M1PR “you do qualify for a property tax refund for 2010,” click File in the Minnesota Property Tax Refund

View, download and print Occupation Tax Return Instructions – Minnesota Department Of Revenue – 2016 pdf template or form online. 1046 Minnesota Tax Forms And

INSTRUCTIONS 2017 Geta fasterrefund, Outlays for Fiscal Year 2016 who is eligible for the premium tax credit, see the Instructions for Form 8962.

extended due dates that begin to take effect with the 2016 tax 4600, 2016 Michigan Business Tax Forms and Instructions for Financial Institutions

If you live in Minnesota, then you live in one of a handful of states that still collect a local estate tax or inheritance tax.

1 Page Minnesota State Tax Tables 2016 Minnesota has made changes to its 2016 state tax tables. Before your first pay of the new year, you must

MINNESOTA TAX FORMS 2016. Revenue Department give up accepting state returns filed with the tax software program. But Minnesota tax officers stated they have

Instructions For Form M2 – Minnesota Income Tax For Estates And Trusts (fiduciary) – 2016

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

Instructions for Form M1PRX 2016 October 15, 2020 What will I need? Minnesota Tax Forms Mail Station 1421 St. Paul, MN 55146-1421..

E-file your tax return directly to the IRS. Prepare state and federal income taxes online. 2017 Minnesota Property Tax Refund Return Form M1pr – File

Forms and Instructions (PDF) Instructions: Tips: 12/31/2016 Form 433-F: Collection (For Certain Excise Tax Activities)

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

Schedule KPC Instructions 2016 Olsen Thielen Certified

Tax Court forms and instructions. skip to content. Forms Index These forms and documents are also Presenting Property Tax Appeals to the Minnesota Tax Court;

Minnesota Income Tax we’ll take a close look at Minnesota’s tax the counties to calculate a total tax burden. Sources: US Census Bureau 2016 American

e-File your 2017 Minnesota Homestead Credit and – Refer to the Minnesota M1PR instructions for complete The last day you can file your 2016 M1PR

2016 MINNESOTA TAX TABLES. Geoduck farming takes off as demand grows in Asia for the tender, odd-wanting 2016 TAX REFUND IN REVIEW; 2016 XOM TAX RATE;

Minnesota Income Taxes and MN State Tax Forms. Minnesota Extension Instructions How to File; No Form. Minnesota grants all 2016 Previous Year Minnesota Tax

delaware tax schedule 2016; tax return ontario calculator 2016; 2016 california tax return tracker; tax return instructions trust 2016; 2016 hong kong tax deadline; aruba tax guide 2016; 2016 tax haven journal; va state tax return 2016; 2016 what is the ohio income tax rate for; tax return due date 2016; china tax revenue 2016; california child tax credit 2016; 2016 application for visitor tax refund …

7y’s income from non-Minnesota sources Fiduciar (see instructions, b.16 Minnesota tax withheld 20 Income Tax Return for Estates and Trusts 2016

INSTRUCTIONS: MINNESOTA 2011 PROPERTY TAX REFUND (Form M1PR) Minnesota residents may apply for a property tax refund by filing a form M1PR. This article discusses the

Wisconsin Department of Revenue: 2016 Tax Forms It’s a no-charge electronic tax filing option. Please read to see if you qualify.

2018-08-20 · Instructions for Form 1040 . Form 4506-T. Request for Transcript of Tax Return. Normal . Form W-4. Minnesota State Website. – differential diagnosis handbook christian sailer MINNESOTA Tax Forms and Instructions Information . Minnesota Individual Income Tax Forms A

tax forms, Minnesota tax forms. you will be able to find it on the Minnesota ‘s tax forms page Income Tax Instructions;

2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Draft 10/13/16 This packet contains: • Instructions for completing the

2016 Individual Income Tax Forms and Homestead Property Tax Credit Claim for Veterans Employee’s Michigan Withholding Exemption Certificate and Instructions.

Find, Download, And Complete Form M1X To Amend Your Minnesota Tax Return. See Step By Step Instructions On How To File A MN Tax Amendment For Various Tax Years.

2016 Oklahoma Partnership Income Tax Return 2 General Filing Information • The due date has changed. See “When and Where the Return Must Be Filed” below.

2016 Massachusetts Corporate Excise Tax Forms for 2016 Form M-8453C – Corporate Tax Declaration Corporate Estimated Tax Payment Vouchers, Instructions and

Minnesota tax forms instructions on filing 2018 state taxes with guides on tax tables, due dates, extensions and forms from the MN department of revenue.

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

2016 Business Income Tax Tax Form Instructions for Corporations: Instructions for filing corporation income tax returns for the calendar year or any other tax

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

Prepare And File Am Amended Minnesota Income Tax Return.

S Corporation Income Tax: Taxable period of January 1, 2016, to December 31, 2016; due April 18, Minnesota Mississippi Missouri Montana Nebraska

Tax Year: 2016; Minnesota Federal and State Income Tax Rate, Minnesota Tax Rate, Minnesota tax tables, Minnesota tax withholding, Minnesota tax tables 2016

Free printable 2017 M1 tax forms and instructions book in PDF format for Minnesota state income tax returns. Print prepare and mail your MN 2017 Form M1 or Form M1NR

Download or print the 2017 Minnesota Form M1 (Individual Income Tax Return) for FREE from the Minnesota Department of Revenue.

and not included in line 1 above (determine from instructions) and Renter Property Tax Refund 2016 Leave unused boxes blank. DO NOT USE STAPLES. Mark an X if a

Minnesota Tax Forms 2017. The guide features step-by-step instructions on how to file Minnesota Amended Minnesota Income Tax . Minnesota Form M1X is a tax

2016 Income Tax Forms DOR Wisconsin Department of

Minnesota State Tax Forms Tax-Rates.org – The Tax

The estate tax rates range from 10% to 16% for 2015 decedents. Estate tax applies for estates larger than .6 million for deaths occurring in 2016; .8 million in 2017; and million in 2018 and beyond. The Form M706 instructions have details on

Form North Dakota Office of State Tax Commissioner 2016 Mark 14 Gross proceeds allocated to North Dakota from sale of research tax credit (See instructions

Income Additions and Subtractions (onscreen version) 2017 M1M, Income Additions and Subtractions *171551* 2017 Schedule M1M, Income Additions and Subtractions Complete this schedule to determine line 3 and line 6 of Form M1.

Form M1PR Property Tax Refund Minnesota Forms – Laws.com

Minnesota Property Tax Refund for Renters and Homeowners

eFile Express Mn Property Tax Refund

State taxes Minnesota Bankrate.com

https://en.wikipedia.org/wiki/Minnesota

Tax Year 2016 Tax Forms and Instructions IRS Tax Map

– 2016 M1PR Property Tax Refund Return

Instructions to Prepare and File Minnesota M1PR (Property

Minnesota Personal Income Tax Extensions TaxExtension.com

2016 M2 Income Tax Return for Estates and Trusts

Tax Year 2016 Tax Forms and Instructions IRS Tax Map

2016 M2 Income Tax Return for Estates and Trusts

Download or print the 2017 Minnesota (Individual Income Tax Return) (2017) and other income tax forms from the Minnesota Department of Revenue.

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

S Corporation Income Tax: Taxable period of January 1, 2016, to December 31, 2016; due April 18, Minnesota Mississippi Missouri Montana Nebraska

Find, Download, And Complete Form M1X To Amend Your Minnesota Tax Return. See Step By Step Instructions On How To File A MN Tax Amendment For Various Tax Years.

Minnesota Income Tax we’ll take a close look at Minnesota’s tax the counties to calculate a total tax burden. Sources: US Census Bureau 2016 American

2016 Massachusetts Corporate Excise Tax Forms for 2016 Form M-8453C – Corporate Tax Declaration Corporate Estimated Tax Payment Vouchers, Instructions and

Minnesota Tax Forms Supported by 1040.com E-File. E-File your Minnesota personal income tax return online with 1040.com. These 2017 forms are available for e-file:

Franchise Tax Return, Form M8, S Corpo- Schedule KPC Instructions 2016 Minnesota source gross income is used to Pass this information through,

If you live in Minnesota, then you live in one of a handful of states that still collect a local estate tax or inheritance tax.

Minnesota Income Taxes and MN State Tax Forms. Minnesota Extension Instructions How to File; No Form. Minnesota grants all 2016 Previous Year Minnesota Tax

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

Minnesota — Individual Income Tax Return Tax-Brackets.org

2016 Minnesota State Tax Information

2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Draft 10/13/16 This packet contains: • Instructions for completing the

2016 Massachusetts Corporate Excise Tax Forms for 2016 Form M-8453C – Corporate Tax Declaration Corporate Estimated Tax Payment Vouchers, Instructions and

State of Minnesota Business Income Tax Extensions. General Instructions. If you owe Minnesota tax,

E-file your tax return directly to the IRS. Prepare state and federal income taxes online. 2017 Minnesota Property Tax Refund Return Form M1pr – File

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

MINNESOTA TAX FORMS 2016. Revenue Department give up accepting state returns filed with the tax software program. But Minnesota tax officers stated they have

Emily

May 2, 2024 — 7:49 pm

Minnesota Income Tax we’ll take a close look at Minnesota’s tax the counties to calculate a total tax burden. Sources: US Census Bureau 2016 American

File Minnesota State Return-MN Tax Return Forms Refund Facts

Morgan

May 4, 2024 — 2:38 am

extended due dates that begin to take effect with the 2016 tax 4600, 2016 Michigan Business Tax Forms and Instructions for Financial Institutions

Minnesota Form M1 (Individual Income Tax Return) 2017

Jonathan

May 5, 2024 — 8:09 am

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

Tax Information Minnesota Internal Revenue Service

Minnesota Property Tax Refund for Renters and Homeowners

Hunter

May 6, 2024 — 5:13 pm

MINNESOTA Tax Forms and Instructions Information . Minnesota Individual Income Tax Forms A

2016 M2 Income Tax Return for Estates and Trusts

Minnesota Personal Income Tax Extensions TaxExtension.com

2016 MN PROPERTY TAX REFUND Tax World

Jacob

May 7, 2024 — 10:04 pm

S Corporation Income Tax: Taxable period of January 1, 2016, to December 31, 2016; due April 18, Minnesota Mississippi Missouri Montana Nebraska

Minnesota — Individual Income Tax Return Tax-Brackets.org

Minnesota Income Tax Calculator SmartAsset.com

Printable Minnesota Income Tax Forms for Tax Year 2017

Hailey

May 7, 2024 — 11:59 pm

How to register to e-file Minnesota income tax returns; Current Year Individual Income Tax Forms Click this link for prior year forms and instructions.

Tax Information Minnesota Internal Revenue Service

Alexis

May 9, 2024 — 4:56 am

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

TaxHow » Minnesota Tax Forms 2017

Schedule KPC Instructions 2016 Olsen Thielen Certified

Minnesota’s Individual Income Tax house.leg.state.mn.us

Destiny

May 9, 2024 — 5:10 am

Tax Court forms and instructions. skip to content. Forms Index These forms and documents are also Presenting Property Tax Appeals to the Minnesota Tax Court;

TaxHow » Minnesota Tax Forms 2017

Andrew

May 9, 2024 — 6:32 am

If you live in Minnesota, then you live in one of a handful of states that still collect a local estate tax or inheritance tax.

MINNESOTA TAX FORMS 2016 Tax & Taxes

2016 PROPERTY TAX REFUND RETURN (M1PR) INSTRUCTIONS

Madison

May 10, 2024 — 11:31 am

2016 MINNESOTA TAX TABLES. Geoduck farming takes off as demand grows in Asia for the tender, odd-wanting 2016 TAX REFUND IN REVIEW; 2016 XOM TAX RATE;

2016 MN PROPERTY TAX REFUND Tax World

Sofia

May 11, 2024 — 5:13 pm

Franchise Tax Return, Form M8, S Corpo- Schedule KPC Instructions 2016 Minnesota source gross income is used to Pass this information through,

Minnesota Form M1 (Individual Income Tax Return) 2017

Thomas

May 13, 2024 — 12:36 am

Minnesota Income Tax we’ll take a close look at Minnesota’s tax the counties to calculate a total tax burden. Sources: US Census Bureau 2016 American

2017 Minnesota Property Tax Refund Return Form M1pr

Luke

May 13, 2024 — 1:06 am

2016 Business Income Tax Tax Form Instructions for Corporations: Instructions for filing corporation income tax returns for the calendar year or any other tax

2017 Minnesota Property Tax Refund Return Form M1pr

Minnesota State Tax Table download.autosoft-asi.com

Amia

May 13, 2024 — 1:42 am

Minnesota’s income tax revenues equaled .7 billion in fiscal year 2016, about 47 percent of state tax collections and 41 percent of all state revenues.

2016 M2 Income Tax Return for Estates and Trusts

Minnesota State Tax Table download.autosoft-asi.com

2016 Minnesota State Tax Information

Jonathan

May 14, 2024 — 8:14 am

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

Minnesota Tax Forms Supported by 1040.com E-File

2016 Minnesota State Tax Information

Jack

May 14, 2024 — 9:16 am

Minnesota Tax Forms 2017. The guide features step-by-step instructions on how to file Minnesota Amended Minnesota Income Tax . Minnesota Form M1X is a tax

Minnesota Property Tax Refund for Renters and Homeowners

File Minnesota State Return-MN Tax Return Forms Refund Facts

Tax Year 2016 Tax Forms and Instructions IRS Tax Map

Samuel

May 15, 2024 — 1:27 pm

INSTRUCTIONS 2017 Geta fasterrefund, Outlays for Fiscal Year 2016 who is eligible for the premium tax credit, see the Instructions for Form 8962.

Minnesota tax tables Minnesota state withholding 2016

Search Page / Minnesota.gov

Katherine

May 15, 2024 — 2:05 pm

Forms and Instructions (PDF) Instructions: Tips: 12/31/2016 Form 433-F: Collection (For Certain Excise Tax Activities)

Minnesota Business Income Tax Extensions FileLater

Minnesota — Individual Income Tax Return Tax-Brackets.org

Minnesota Form M1 (Individual Income Tax Return) 2017

Kevin

May 15, 2024 — 2:33 pm

How to register to e-file Minnesota income tax returns; Current Year Individual Income Tax Forms Click this link for prior year forms and instructions.

Printable Minnesota Income Tax Forms for Tax Year 2017

Minnesota Tax Forms Supported by 1040.com E-File

Tyler

May 16, 2024 — 8:21 pm

2016 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2016 tangible personal property tax return. Please:

Minnesota Income Tax Calculator SmartAsset.com

Search Page / Minnesota.gov

Joseph

May 18, 2024 — 3:25 am

Instructions For Form M2 – Minnesota Income Tax For Estates And Trusts (fiduciary) – 2016

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

Maria

May 18, 2024 — 4:55 am

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

MINNESOTA TAX TABLES 2016

MINNESOTA TAX FORMS 2016 Tax & Taxes

Occupation Tax Return Instructions Minnesota Department

Isaac

May 19, 2024 — 11:32 am

Topic page for Tax Year 2016 Tax Forms and Instructions

MINNESOTA TAX FORMS 2016 Tax & Taxes

Form M1PR Property Tax Refund Minnesota Forms – Laws.com

2016 M1PR Property Tax Refund Return

Caleb

May 20, 2024 — 6:27 pm

Tax Year: 2016; Minnesota Federal and State Income Tax Rate, Minnesota Tax Rate, Minnesota tax tables, Minnesota tax withholding, Minnesota tax tables 2016

Minnesota — Individual Income Tax Return Tax-Brackets.org

Brandon

May 20, 2024 — 6:37 pm

Minnesota tax forms instructions on filing 2018 state taxes with guides on tax tables, due dates, extensions and forms from the MN department of revenue.

Search Page / Minnesota.gov

2016 Minnesota State Tax Information

Instructions For Form M2 Minnesota Income Tax For

Zoe

May 23, 2024 — 5:45 am

2015 Minnesota Individual Income Tax Forms and Instructions Includes Form M1 and Schedules M1W, M1MA, M1M, M1ED, and M1WFC Tired of filling out paper forms?

2016 M2 Income Tax Return for Estates and Trusts

Michelle

May 23, 2024 — 6:45 am

extended due dates that begin to take effect with the 2016 tax 4600, 2016 Michigan Business Tax Forms and Instructions for Financial Institutions

Printable Minnesota Income Tax Forms for Tax Year 2017

2016 M1PR Property Tax Refund Return

Kimberly

May 23, 2024 — 8:01 am

2016 Business Income Tax Tax Form Instructions for Corporations: Instructions for filing corporation income tax returns for the calendar year or any other tax

Form M1PR Property Tax Refund Minnesota Forms – Laws.com

Gavin

May 24, 2024 — 2:46 pm

and not included in line 1 above (determine from instructions) and Renter Property Tax Refund 2016 Leave unused boxes blank. DO NOT USE STAPLES. Mark an X if a

2016 M2 Income Tax Return for Estates and Trusts

MINNESOTA TAX TABLES 2016

MINNESOTA Tax Forms and Instructions

Lily

May 25, 2024 — 9:23 pm

INSTRUCTIONS: MINNESOTA 2011 PROPERTY TAX REFUND (Form M1PR) Minnesota residents may apply for a property tax refund by filing a form M1PR. This article discusses the

MINNESOTA TAX TABLES 2016

Printable Minnesota Income Tax Forms for Tax Year 2017

Luke

May 25, 2024 — 9:28 pm

Minnesota Income Tax we’ll take a close look at Minnesota’s tax the counties to calculate a total tax burden. Sources: US Census Bureau 2016 American

TAXES 16-11 Minnesota State Income Tax Withholding

Jordan

May 25, 2024 — 9:50 pm

Instructions to Prepare and File Minnesota M1PR “you do qualify for a property tax refund for 2010,” click File in the Minnesota Property Tax Refund

MINNESOTA TAX TABLES 2016

Lillian

May 27, 2024 — 2:20 am

tax forms, Minnesota tax forms. you will be able to find it on the Minnesota ‘s tax forms page Income Tax Instructions;

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

Minnesota tax tables Minnesota state withholding 2016

Kaitlyn

May 27, 2024 — 4:25 am

2016 Individual Income Tax Forms and Homestead Property Tax Credit Claim for Veterans Employee’s Michigan Withholding Exemption Certificate and Instructions.

2016 Income Tax Forms DOR Wisconsin Department of

Minnesota Form M1M (Income Additions and Subtractions

Ava

May 28, 2024 — 8:40 am

Free printable 2017 M1 tax forms and instructions book in PDF format for Minnesota state income tax returns. Print prepare and mail your MN 2017 Form M1 or Form M1NR

Can I file my M1PR TurboTax® Support – Get Help Using

Minnesota Business Income Tax Extensions FileLater

Mia

May 28, 2024 — 9:53 am

INSTRUCTIONS: MINNESOTA 2011 PROPERTY TAX REFUND (Form M1PR) Minnesota residents may apply for a property tax refund by filing a form M1PR. This article discusses the

Forms Index Minnesota.gov

Minnesota Personal Income Tax Extensions TaxExtension.com

Minnesota Form M1M (Income Additions and Subtractions

William

May 28, 2024 — 10:45 am

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

Minnesota Tax Forms Supported by 1040.com E-File

Michelle

May 29, 2024 — 5:00 pm

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

Search Page / Minnesota.gov

Mackenzie

May 31, 2024 — 12:28 am

The estate tax rates range from 10% to 16% for 2015 decedents. Estate tax applies for estates larger than .6 million for deaths occurring in 2016; .8 million in 2017; and million in 2018 and beyond. The Form M706 instructions have details on

2016 Minnesota State Tax Information

Instructions to Prepare and File Minnesota M1PR (Property

Instructions for Form M1PRX zillionforms.com

Natalie

June 1, 2024 — 4:57 am

State of Minnesota Business Income Tax Extensions. General Instructions. If you owe Minnesota tax,

Can I file my M1PR TurboTax® Support – Get Help Using

Angel

June 1, 2024 — 6:16 am

2016 Business Income Tax Tax Form Instructions for Corporations: Instructions for filing corporation income tax returns for the calendar year or any other tax

Minnesota Tax Forms Filing Taxes in MN (2018 Tax Year)

2016 Minnesota State Tax Information

Alyssa

June 1, 2024 — 6:56 am

Form North Dakota Office of State Tax Commissioner 2016 Mark 14 Gross proceeds allocated to North Dakota from sale of research tax credit (See instructions

Minnesota Estate Tax Laws and Regulations The Balance

Prepare And File Am Amended Minnesota Income Tax Return.

David

June 3, 2024 — 6:41 pm

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

2016 M2 Income Tax Return for Estates and Trusts

2016 Minnesota State Tax Information

2016 M1PR Property Tax Refund Return

Gavin

June 3, 2024 — 8:12 pm

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

MINNESOTA Tax Forms and Instructions

Minnesota Business Income Tax Extensions FileLater

TaxHow » Minnesota Tax Forms 2017

Katelyn

June 5, 2024 — 1:26 am

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

Search Page / Minnesota.gov

eFile Express Mn Property Tax Refund

Gabriel

June 5, 2024 — 2:14 am

Instructions For Form M2 – Minnesota Income Tax For Estates And Trusts (fiduciary) – 2016

Instructions for Form M1PRX zillionforms.com

Tax Information Minnesota Internal Revenue Service

Schedule KPC Instructions 2016 Olsen Thielen Certified

Samantha

June 6, 2024 — 7:07 am

2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Draft 10/13/16 This packet contains: • Instructions for completing the

Minnesota — Individual Income Tax Return Tax-Brackets.org

Christian

June 6, 2024 — 8:21 am

Instructions to Prepare and File Minnesota M1PR “you do qualify for a property tax refund for 2010,” click File in the Minnesota Property Tax Refund

Minnesota’s Individual Income Tax house.leg.state.mn.us

TaxHow » Minnesota Tax Forms 2017

Benjamin

June 6, 2024 — 9:14 am

delaware tax schedule 2016; tax return ontario calculator 2016; 2016 california tax return tracker; tax return instructions trust 2016; 2016 hong kong tax deadline; aruba tax guide 2016; 2016 tax haven journal; va state tax return 2016; 2016 what is the ohio income tax rate for; tax return due date 2016; china tax revenue 2016; california child tax credit 2016; 2016 application for visitor tax refund …

eFile Express Mn Property Tax Refund

MINNESOTA TAX FORMS 2016 Tax & Taxes

Robert

June 6, 2024 — 9:59 am

Free printable 2017 M1 tax forms and instructions book in PDF format for Minnesota state income tax returns. Print prepare and mail your MN 2017 Form M1 or Form M1NR

2016 PROPERTY TAX REFUND RETURN (M1PR) INSTRUCTIONS

Jasmine

June 7, 2024 — 4:32 pm

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

MINNESOTA Tax Forms and Instructions

Maria

June 8, 2024 — 10:05 pm

View, download and print Occupation Tax Return Instructions – Minnesota Department Of Revenue – 2016 pdf template or form online. 1046 Minnesota Tax Forms And

2017 Minnesota Property Tax Refund Return Form M1pr

2016 MN PROPERTY TAX REFUND Tax World

Minnesota Personal Income Tax Extensions TaxExtension.com

Isaac

June 8, 2024 — 10:35 pm

2015 Minnesota Individual Income Tax Forms and Instructions Includes Form M1 and Schedules M1W, M1MA, M1M, M1ED, and M1WFC Tired of filling out paper forms?

Printable Minnesota Income Tax Forms for Tax Year 2017

Bryan

June 8, 2024 — 10:52 pm

2016 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2016 tangible personal property tax return. Please:

2016 M1PR Property Tax Refund Return

Noah

June 8, 2024 — 11:51 pm

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

MINNESOTA Tax Forms and Instructions

Kylie

June 10, 2024 — 3:28 am

How to register to e-file Minnesota income tax returns; Current Year Individual Income Tax Forms Click this link for prior year forms and instructions.

Minnesota’s Individual Income Tax house.leg.state.mn.us

TaxHow » Minnesota Tax Forms 2017

Alexis

June 10, 2024 — 5:54 am

Instructions for Form M1PRX 2016 October 15, 2020 What will I need? Minnesota Tax Forms Mail Station 1421 St. Paul, MN 55146-1421..

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

2016 PROPERTY TAX REFUND RETURN (M1PR) INSTRUCTIONS

Olivia

June 12, 2024 — 4:44 pm

Income Additions and Subtractions (onscreen version) 2017 M1M, Income Additions and Subtractions *171551* 2017 Schedule M1M, Income Additions and Subtractions Complete this schedule to determine line 3 and line 6 of Form M1.

Search Page / Minnesota.gov

Jordan

June 15, 2024 — 6:10 am

Tax Court forms and instructions. skip to content. Forms Index These forms and documents are also Presenting Property Tax Appeals to the Minnesota Tax Court;

Minnesota Tax Forms Filing Taxes in MN (2018 Tax Year)

Search Page / Minnesota.gov

Riley

June 16, 2024 — 1:36 pm

Instructions for Form M1PRX 2016 October 15, 2020 What will I need? Minnesota Tax Forms Mail Station 1421 St. Paul, MN 55146-1421..

MINNESOTA TAX FORMS 2016 Tax & Taxes

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

Taylor

June 16, 2024 — 2:28 pm

Instructions For Form M2 – Minnesota Income Tax For Estates And Trusts (fiduciary) – 2016

File Minnesota State Return-MN Tax Return Forms Refund Facts

Prepare And File Am Amended Minnesota Income Tax Return.

Logan

June 17, 2024 — 8:58 pm

2016 MN PROPERTY TAX REFUND. mn property tax refund 2016 – minnesota property tax minimum income level for Malaysia income tax payment; form 709 instructions

2016 M1PR Property Tax Refund Return

Minnesota Income Tax Calculator SmartAsset.com

Allison

June 17, 2024 — 10:17 pm

2016 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2016 tangible personal property tax return. Please:

Can I file my M1PR TurboTax® Support – Get Help Using

Minnesota State Tax Forms Tax-Rates.org – The Tax

Isabella

June 17, 2024 — 10:38 pm

7y’s income from non-Minnesota sources Fiduciar (see instructions, b.16 Minnesota tax withheld 20 Income Tax Return for Estates and Trusts 2016

Schedule KPC Instructions 2016 Olsen Thielen Certified

2016 M1PR Property Tax Refund Return

Minnesota Tax Forms Filing Taxes in MN (2018 Tax Year)

Katherine

June 19, 2024 — 2:17 am

Download or print the 2017 Minnesota Form M1 (Individual Income Tax Return) for FREE from the Minnesota Department of Revenue.

Minnesota Tax Forms Supported by 1040.com E-File

Minnesota State Tax Table download.autosoft-asi.com

2016 M2 Income Tax Return for Estates and Trusts

Michael

June 19, 2024 — 2:23 am

Form North Dakota Office of State Tax Commissioner 2016 Mark 14 Gross proceeds allocated to North Dakota from sale of research tax credit (See instructions

Instructions For Form M2 Minnesota Income Tax For

Minnesota — Individual Income Tax Return Tax-Brackets.org

Minnesota Tax Forms Supported by 1040.com E-File

Isaac

June 19, 2024 — 3:11 am

E-file your tax return directly to the IRS. Prepare state and federal income taxes online. 2017 Minnesota Property Tax Refund Return Form M1pr – File

Minnesota Business Income Tax Extensions FileLater

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

Katelyn

June 19, 2024 — 3:35 am

7y’s income from non-Minnesota sources Fiduciar (see instructions, b.16 Minnesota tax withheld 20 Income Tax Return for Estates and Trusts 2016

Minnesota Form M1 (Individual Income Tax Return) 2017

Anna

June 19, 2024 — 5:29 am

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

Minnesota Tax Forms 2017 Printable Minnesota State Form

Minnesota Estate Tax Laws and Regulations The Balance

State taxes Minnesota Bankrate.com

Eric

June 20, 2024 — 8:54 am

MINNESOTA TAX FORMS 2016. Revenue Department give up accepting state returns filed with the tax software program. But Minnesota tax officers stated they have

Occupation Tax Return Instructions Minnesota Department

Adam

June 21, 2024 — 3:39 pm

2016 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2016 tangible personal property tax return. Please:

Tax Year 2016 Tax Forms and Instructions IRS Tax Map

Katelyn

June 21, 2024 — 4:53 pm

MINNESOTA TAX FORMS 2016. Revenue Department give up accepting state returns filed with the tax software program. But Minnesota tax officers stated they have

2016 PROPERTY TAX REFUND RETURN (M1PR) INSTRUCTIONS

Minnesota Personal Income Tax Extensions TaxExtension.com

Gabriel

June 21, 2024 — 5:57 pm

General Instructions. Minnesota individual income tax returns are due by the 15 th day of the 4 th month following the close of the tax year.

Minnesota Personal Income Tax Extensions TaxExtension.com

Prepare And File Am Amended Minnesota Income Tax Return.

Irea

June 22, 2024 — 10:23 pm

Download or print the 2017 Minnesota Form M1 (Individual Income Tax Return) for FREE from the Minnesota Department of Revenue.

Minnesota Estate Tax Laws and Regulations The Balance

Julia

June 23, 2024 — 1:08 am

If you live in Minnesota, then you live in one of a handful of states that still collect a local estate tax or inheritance tax.

Schedule KPC Instructions 2016 Olsen Thielen Certified

Gavin

June 24, 2024 — 5:02 am

e-File your 2017 Minnesota Homestead Credit and – Refer to the Minnesota M1PR instructions for complete The last day you can file your 2016 M1PR

Minnesota — Individual Income Tax Return Tax-Brackets.org

TaxHow » Tax Forms » Minnesota Schedule M1M

Anna

June 24, 2024 — 6:04 am

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

2017 Minnesota Property Tax Refund Return Form M1pr

Form M1PR Property Tax Refund Minnesota Forms – Laws.com

Ryan

June 24, 2024 — 8:15 am

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

Minnesota State Tax Forms Tax-Rates.org – The Tax

Jessica

June 25, 2024 — 11:59 am

2015 Minnesota Individual Income Tax Forms and Instructions Includes Form M1 and Schedules M1W, M1MA, M1M, M1ED, and M1WFC Tired of filling out paper forms?

Minnesota Personal Income Tax Extensions TaxExtension.com

Mason

June 25, 2024 — 2:05 pm

e-File your 2017 Minnesota Homestead Credit and – Refer to the Minnesota M1PR instructions for complete The last day you can file your 2016 M1PR

Printable Minnesota Income Tax Forms for Tax Year 2017

State taxes Minnesota Bankrate.com

Leah

June 25, 2024 — 2:52 pm

delaware tax schedule 2016; tax return ontario calculator 2016; 2016 california tax return tracker; tax return instructions trust 2016; 2016 hong kong tax deadline; aruba tax guide 2016; 2016 tax haven journal; va state tax return 2016; 2016 what is the ohio income tax rate for; tax return due date 2016; china tax revenue 2016; california child tax credit 2016; 2016 application for visitor tax refund …

Instructions to Prepare and File Minnesota M1PR (Property

Minnesota tax tables Minnesota state withholding 2016

Printable Minnesota Income Tax Forms for Tax Year 2017

Rachel

June 27, 2024 — 12:11 am

The estate tax rates range from 10% to 16% for 2015 decedents. Estate tax applies for estates larger than .6 million for deaths occurring in 2016; .8 million in 2017; and million in 2018 and beyond. The Form M706 instructions have details on

File Minnesota State Return-MN Tax Return Forms Refund Facts

Minnesota Tax Forms Filing Taxes in MN (2018 Tax Year)

MINNESOTA TAX FORMS 2016 Tax & Taxes

Katelyn

June 27, 2024 — 1:23 am

Wisconsin Department of Revenue: 2016 Tax Forms It’s a no-charge electronic tax filing option. Please read to see if you qualify.

State taxes Minnesota Bankrate.com

Minnesota Property Tax Refund for Renters and Homeowners

MINNESOTA Tax Forms and Instructions

Bryan

June 28, 2024 — 4:32 pm

2016 Business Income Tax Tax Form Instructions for Corporations: Instructions for filing corporation income tax returns for the calendar year or any other tax

Minnesota Form M1M (Income Additions and Subtractions

Angel

June 30, 2024 — 12:14 am

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

2016 MINNESOTA TAX TABLES

Form M1PR Property Tax Refund Minnesota Forms – Laws.com

Carlos

June 30, 2024 — 1:22 am

2016 Massachusetts Corporate Excise Tax Forms for 2016 Form M-8453C – Corporate Tax Declaration Corporate Estimated Tax Payment Vouchers, Instructions and

Minnesota’s Individual Income Tax house.leg.state.mn.us

TaxHow » Tax Forms » Minnesota Schedule M1M

Sydney

June 30, 2024 — 3:35 am

Tax Year: 2016; Minnesota Federal and State Income Tax Rate, Minnesota Tax Rate, Minnesota tax tables, Minnesota tax withholding, Minnesota tax tables 2016

2016 Minnesota State Tax Information

Faith

July 1, 2024 — 2:27 pm

Print or download 96 Minnesota Income Tax Forms for FREE from the Minnesota Department of Revenue.

Search Page / Minnesota.gov

2016 M2 Income Tax Return for Estates and Trusts

Taylor

July 1, 2024 — 2:54 pm

7y’s income from non-Minnesota sources Fiduciar (see instructions, b.16 Minnesota tax withheld 20 Income Tax Return for Estates and Trusts 2016

Minnesota Tax Forms Filing Taxes in MN (2018 Tax Year)

Instructions for Form M1PRX zillionforms.com

File Minnesota State Return-MN Tax Return Forms Refund Facts

Ian

July 1, 2024 — 3:19 pm

Minnesota Tax Forms Supported by 1040.com E-File. E-File your Minnesota personal income tax return online with 1040.com. These 2017 forms are available for e-file:

State taxes Minnesota Bankrate.com

Andrew

July 1, 2024 — 3:54 pm

Minnesota tax forms instructions on filing 2018 state taxes with guides on tax tables, due dates, extensions and forms from the MN department of revenue.

2017 Minnesota Property Tax Refund Return Form M1pr

Zachary

July 3, 2024 — 2:52 am

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

Minnesota Income Tax Rate and MN Tax Brackets 2017 2018

Minnesota State Tax Table download.autosoft-asi.com

Gabriel

July 3, 2024 — 2:58 am

2016 Minnesota State Tax Information . Minnesota Department of Revenue: To verify the 2016 tax information, Changing a Tax for detailed instructions to

Instructions to Prepare and File Minnesota M1PR (Property

Aiden

July 3, 2024 — 3:24 am

Franchise Tax Return, Form M8, S Corpo- Schedule KPC Instructions 2016 Minnesota source gross income is used to Pass this information through,

Forms Index Minnesota.gov

Minnesota tax tables Minnesota state withholding 2016

Minnesota Tax Forms 2017 Printable Minnesota State Form

Alexis

July 3, 2024 — 5:53 am

Download or print the 2017 Minnesota (Individual Income Tax Return) (2017) and other income tax forms from the Minnesota Department of Revenue.

Prepare And File Am Amended Minnesota Income Tax Return.

TaxHow » Minnesota Tax Forms 2017

Riley

July 3, 2024 — 6:07 am

Minnesota Income Tax Rate 2017 – 2018. Minnesota state income tax rate table for the 2017 – 2018 filing season has four income tax brackets with MN tax rates of 5.35%

Search Page / Minnesota.gov

Minnesota Property Tax Refund for Renters and Homeowners

Faith

July 3, 2024 — 6:16 am

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

State taxes Minnesota Bankrate.com

Luke

July 4, 2024 — 3:53 pm

2016 Massachusetts Corporate Excise Tax Forms for 2016 Form M-8453C – Corporate Tax Declaration Corporate Estimated Tax Payment Vouchers, Instructions and

2016 Income Tax Forms DOR Wisconsin Department of

Minnesota State Tax Forms Tax-Rates.org – The Tax

Jesus

July 4, 2024 — 4:27 pm

extended due dates that begin to take effect with the 2016 tax 4600, 2016 Michigan Business Tax Forms and Instructions for Financial Institutions

MINNESOTA Tax Forms and Instructions

2016 M2 Income Tax Return for Estates and Trusts

Minnesota Estate Tax Laws and Regulations The Balance

Sean

July 4, 2024 — 6:13 pm

2016 Oklahoma Partnership Income Tax Return 2 General Filing Information • The due date has changed. See “When and Where the Return Must Be Filed” below.

Printable Minnesota Income Tax Forms for Tax Year 2017

Minnesota Property Tax Refund for Renters and Homeowners

Eric

July 4, 2024 — 7:44 pm

Minnesota Schedule M1M 2017 Minnesota Income to their Minnesota income tax return. Minnesota Schedule M1M must be filed to determine 2015 2016 2017. Why

Schedule KPC Instructions 2016 Olsen Thielen Certified

Evan

July 6, 2024 — 9:06 am

minnesota tax tables 2016. minnesota tax tables. 2016 tax free weekend ga 2016; japan corporate tax rate 2016; search: tax brackets for 2016;

eFile Express Mn Property Tax Refund

Occupation Tax Return Instructions Minnesota Department

Forms Index Minnesota.gov

Lily

July 6, 2024 — 11:25 am

2016 Individual Income Tax Forms and Homestead Property Tax Credit Claim for Veterans Employee’s Michigan Withholding Exemption Certificate and Instructions.

Minnesota State Tax Forms Tax-Rates.org – The Tax

Printable Minnesota Income Tax Forms for Tax Year 2017

Minnesota State Tax Table download.autosoft-asi.com

Hannah

July 7, 2024 — 8:00 pm

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We’ll make sure you qualify, calculate your Minnesota property tax refund, and

Tax Information Minnesota Internal Revenue Service

Minnesota Personal Income Tax Extensions TaxExtension.com

2016 MN PROPERTY TAX REFUND Tax World

Lily

July 7, 2024 — 9:34 pm

Minnesota’s income tax revenues equaled .7 billion in fiscal year 2016, about 47 percent of state tax collections and 41 percent of all state revenues.

TaxHow » Tax Forms » Minnesota Schedule M1M